The Supreme Court on Wednesday issued notice to the Centre, Google India, Yahoo India and Microsoft Corporation on a petition seeking a ban on popular online search engines promoting sex selection techniques.

A three-Judge Bench of Chief Justice K.G. Balakrishnan and Justices P. Sathasivam and J.M. Panchal issued notice on a writ petition filed by Dr. Sabu Mathew George highlighting the violation of Preconception and Prenatal Diagnostic Techniques Act by the websites.

Counsel Sanjay Parikh submitted that despite bringing the websites to the notice of the departments concerned, no steps were taken to block them. He said the petition was filed for full and effective implementation of the Act.

He sought a direction to the Centre to block all websites, including those of Google, Yahoo and Microsoft, that violated the Act.

Dr. George wanted a direction to the Centre to take punitive and deterrent action against these three companies.

It is funny that even though Google's adwords policy does not allows this

advertising when ads are targeted to India, it still shows up.

It is banned because of selective abortion for past centuries have resulted in dip in girl population. The sex ratio in many parts is almost 900 to 1000 men.

Thursday, August 14, 2008

India to sue Google, Yahoo & Microsoft for sex selection ads

Sunday, May 4, 2008

Yahoo faces difficult monday

Techcrunch reports that Yahoo is frantically trying to negotiate a deal with Google to outsource search advertising and get it announced before the markets open tomorrow. Yahoo has lost the lions share of negotiating leverage. That means a lower revenue share, a shorter term deal, etc.

Yahoo to announce their delayed annual shareholder meeting early this week, and actually hold it as early as late June. When it’s announced, shareholders have ten days to propose an alternate slate of board members. Microsoft says they are sitting on the sidelines, but a group of angry stockholders may now emboldened enough to make their own effort to change company management.

To say that shareholders are angry is an understatement. They made it clear to anyone who’d talk to them that they would be more than happy with Microsoft’s $33/share final offer. Legg Mason, Capital Research, T. Rowe Price and others all reportedly strongly wanted the Microsoft deal to happen.

Saturday, May 3, 2008

Microsoft's Steven Ballmer's letter to Yahoo's Jerry Yang on abandoning of the deal

Yahoo's trick of outsourcing ads placement to Google seems to have paid off.

Below is the text of the letter from Microsoft CEO Steve Ballmer to Yahoo! CEO Jerry Yang.

May 3, 2008

Mr. Jerry Yang

CEO and Chief Yahoo

Yahoo! Inc.

701 First Avenue

Sunnyvale, CA 94089

Dear Jerry:

After over three months, we have reached the conclusion of the process regarding a possible combination of Microsoft and Yahoo!.

I first want to convey my personal thanks to you, your management team, and Yahoo!’s Board of Directors for your consideration of our proposal. I appreciate the time and attention all of you have given to this matter, and I especially appreciate the time that you have invested personally. I feel that our discussions this week have been particularly useful, providing me for the first time with real clarity on what is and is not possible.

I am disappointed that Yahoo! has not moved towards accepting our offer. I first called you with our offer on January 31 because I believed that a combination of our two companies would have created real value for our respective shareholders and would have provided consumers, publishers, and advertisers with greater innovation and choice in the marketplace. Our decision to offer a 62 percent premium at that time reflected the strength of these convictions.

In our conversations this week, we conveyed our willingness to raise our offer to $33.00 per share, reflecting again our belief in this collective opportunity. This increase would have added approximately another $5 billion of value to your shareholders, compared to the current value of our initial offer. It also would have reflected a premium of over 70 percent compared to the price at which your stock closed on January 31. Yet it has proven insufficient, as your final position insisted on Microsoft paying yet another $5 billion or more, or at least another $4 per share above our $33.00 offer.

Also, after giving this week’s conversations further thought, it is clear to me that it is not sensible for Microsoft to take our offer directly to your shareholders. This approach would necessarily involve a protracted proxy contest and eventually an exchange offer. Our discussions with you have led us to conclude that, in the interim, you would take steps that would make Yahoo! undesirable as an acquisition for Microsoft.

We regard with particular concern your apparent planning to respond to a “hostile” bid by pursuing a new arrangement that would involve or lead to the outsourcing to Google of key paid Internet search terms offered by Yahoo! today. In our view, such an arrangement with the dominant search provider would make an acquisition of Yahoo! undesirable to us for a number of reasons:

· First, it would fundamentally undermine Yahoo!’s own strategy and long-term viability by encouraging advertisers to use Google as opposed to your Panama paid search system. This would also fragment your search advertising and display advertising strategies and the ecosystem surrounding them. This would undermine the reliance on your display advertising business to fuel future growth.

· Given this, it would impair Yahoo’s ability to retain the talented engineers working on advertising systems that are important to our interest in a combination of our companies.

· In addition, it would raise a host of regulatory and legal problems that no acquirer, including Microsoft, would want to inherit. Among other things, this would consolidate market share with the already-dominant paid search provider in a manner that would reduce competition and choice in the marketplace.

· This would also effectively enable Google to set the prices for key search terms on both their and your search platforms and, in the process, raise prices charged to advertisers on Yahoo. In addition to whatever resulting legal problems, this seems unwise from a business perspective unless in fact one simply wishes to use this as a vehicle to exit the paid search business in favor of Google.

· It could foreclose any chance of a combination with any other search provider that is not already relying on Google’s search services.

Accordingly, your apparent plan to pursue such an arrangement in the event of a proxy contest or exchange offer leads me to the firm decision not to pursue such a path. Instead, I hereby formally withdraw Microsoft’s proposal to acquire Yahoo!.

We will move forward and will continue to innovate and grow our business at Microsoft with the talented team we have in place and potentially through strategic transactions with other business partners.

I still believe even today that our offer remains the only alternative put forward that provides your stockholders full and fair value for their shares. By failing to reach an agreement with us, you and your stockholders have left significant value on the table.

But clearly a deal is not to be.

Thank you again for the time we have spent together discussing this.

Sincerely yours,

/s/ Steven A. Ballmer

Steven A. Ballmer

Chief Executive Officer

Microsoft Corporation

Here is the threatening letter Microsoft had send to Yahoo few weeks back regarding hostile takeover.

Thursday, May 1, 2008

Yahoo set to show Google ads on search results

Yahoo Inc. could announce an agreement to carry search advertisements from Google Inc. within a week, as it braces for Microsoft Corp. to go hostile or abandon its unsolicited acquisition offer for Yahoo, say people familiar with the matter.

Yahoo was waiting for Microsoft to announce its approach this week, after the two sides failed to reach a negotiated deal amid a divide on price. But Yahoo has also been pursuing a broad agreement to carry search ads from Google, which it views as a way to boost its cash flow and bolster its claim to shareholders that it is still capable of being alone

Monday, April 14, 2008

Thursday, April 10, 2008

Google to rescue Yahoo from forced marriage to microsoft

Here is the plot.

A very rich and powerful landlord Microsoft is forcing a beautiful girl Yahoo into marrying him. He is trying to attract her by giving her lot of expensive gifts. But the girl does not wants to marry him. She wants to remain free. The Landlord warns the girl that if she doesn't marry him then he will take her away forcibly.

Enters a very handsome and rich and powerful Knight from a distant land ie. Google. He is accompanied by his trusted assistant America Online code named AOL. They come to know about the damsel in distress and promise to help her.

In anger the land lord hires a dreaded dark knight News corp. to help him.

The story will be continued later........

Sunday, April 6, 2008

Yahoo details plans for new online ad sales system

Yahoo Inc on Sunday detailed plans for its forthcoming Web advertising management system that gives its ad sales-partners access to online ad space both on Yahoo and other major sites.

The widely anticipated system, known as AMP!, aims to simplify the process of buying and selling online ads for advertisers, ad agencies, fast-growing ad trading networks and Web site publishers.

The ad management system seeks to capitalize on Yahoo's strength as a Web site publisher that reaches 500 million Web users monthly and recent efforts to sell ads off of Yahoo through major partnerships or specialized ad-sales networks.

The planned advertising system, formerly code-named Apex, is the lynchpin of the company's strategy to reach outside its own base of users and increase its position as the "must buy" location for online advertisers.

While the strategy remains in its early stages, AMP! is one of the products which Yahoo management believes will help propel the Web pioneer's next wave of growth. It is also one factor behind Yahoo's reluctance to accept Microsoft Corp's unsolicited takeover bid currently valued at $42.4 billion, which executives believe undervalues the company's assets.

AMP! will be introduced in stages starting in the third quarter of this year, Yahoo said. It aims to give individual sites the capacity to sell ads across the Web, replacing single-site systems that still use e-mail and even faxes.

The move also is a response to major competitors Google Inc and Microsoft Corp, which have each acquired major competitors in the market for sales of online display ads used by corporate brand marketers. Google closed its $3.4 billion acquisition of ad sales management firm DoubleClick last month. Microsoft paid $6 billion for aQuantive last May.

AMP! is a suite of tools that offers precise geographic, demographic, and interest-based targeting across a vast network of Yahoo sites and ad sales deals Yahoo has struck with more than 600 newspapers, Comcast and eBay Inc.

It also includes niche Web sites such as WebMD, Forbes, the major ad networks, and thousands of smaller sites on the Web.

In its initial stages, AMP! is designed to expand the reach of dedicated sales forces at newspapers or sites such as WebMD to allow them to reach many times larger audiences outside of their own sites, where they can cross-sell their advertising.

Saturday, April 5, 2008

Learn how to write threatening letters with microsoft

Dear Members of the Board:

It has now been more than two months since we made our proposal to acquire Yahoo! at a 62% premium to its closing price on January 31, 2008, the day prior to our announcement. Our goal in making such a generous offer was to create the basis for a speedy and ultimately friendly transaction. Despite this, the pace of the last two months has been anything but speedy.

While there has been some limited interaction between management of our two companies, there has been no meaningful negotiation to conclude an agreement. We understand that you have been meeting to consider and assess your alternatives, including alternative transactions with others in the industry, but we’ve seen no indication that you have authorized Yahoo! management to negotiate with Microsoft. This is despite the fact that our proposal is the only alternative put forward that offers your shareholders full and fair value for their shares, gives every shareholder a vote on the future of the company, and enhances choice for content creators, advertisers, and consumers.

During these two months of inactivity, the Internet has continued to march on, while the public equity markets and overall economic conditions have weakened considerably, both in general and for other Internet-focused companies in particular. At the same time, public indicators suggest that Yahoo!’s search and page view shares have declined. Finally, you have adopted new plans at the company that have made any change of control more costly.

By any fair measure, the large premium we offered in January is even more significant today. We believe that the majority of your shareholders share this assessment, even after reviewing your public disclosures relating to your future prospects.

Given these developments, we believe now is the time for our respective companies to authorize teams to sit down and negotiate a definitive agreement on a combination of our companies that will deliver superior value to our respective shareholders, creating a more efficient and competitive company that will provide greater value and service to our customers. If we have not concluded an agreement within the next three weeks, we will be compelled to take our case directly to your shareholders, including the initiation of a proxy contest to elect an alternative slate of directors for the Yahoo! board. The substantial premium reflected in our initial proposal anticipated a friendly transaction with you. If we are forced to take an offer directly to your shareholders, that action will have an undesirable impact on the value of your company from our perspective which will be reflected in the terms of our proposal.

It is unfortunate that by choosing not to enter into substantive negotiations with us, you have failed to give due consideration to a transaction that has tremendous benefits for Yahoo!’s shareholders and employees. We think it is critically important not to let this window of opportunity pass.

Sincerely,

Steven A. Ballmer

Chief Executive Office

Microsoft Corp.

Tuesday, March 25, 2008

Yahoo, Google, MySpace form non-profit OpenSocial Foundation

Google, Yahoo, and News Corp.'s MySpace.com announced on Tuesday that they have formed the OpenSocial Foundation, a non-profit group to support the OpenSocial initiative that Google kick-started last year as a way to promote a universal standard for developer applications on social-networking sites.

The specific purpose of the new non-profit, according to a release, is "to ensure the neutrality and longevity of OpenSocial as an open, community-governed specification for building social applications across the web." It's a particularly crucial move for Google, which has been eager to emphasize that OpenSocial is a community standard, not a Mountain View project.

"OpenSocial has been a community-driven specification from the beginning," Joe Kraus, Google's director of product management, said in a joint statement from the three companies. "The formation of this foundation will ensure that it remains so in perpetuity. Developers and websites should feel secure that OpenSocial will be forever free and open."

Saturday, February 2, 2008

Adsense racist?

1.Well it has been quite a long time since, Adsense has introduced Electronic Clearance. It allows publishers to directly transfer their money to their bank account. Many countries like US,UK,Italy,etc have been included but India has been ignored till now. Even PayPal.com has started this and that to free if the amount exceeds Rs.7000.

2.Adsense have started Video units which are are customizable YouTube players you can place on yoursite; the player will play YouTube videos, and text ads will be

displayed within the player. It is available only in US,UK and some other countries. Adsense snubbed India even though it has more English speaking population than UK.

3.Now an announcement has been made that they will no longer support Adsense referrals in India.

Good News is that Microsoft is buying Yahoo. This might drum up Yahoo's YPN and it might come out of beta and be available to publishers outside US.

What do you say?

Friday, February 1, 2008

Microsoft bids $45 billion for Yahoo

Microsoft Corp. made an unsolicited $44.6 billion cash and stock bid for Yahoo on Friday, a deal that could shake up the competitive and lucrative market for Internet search.

The deal would pay Yahoo shareholders $31 a share, which represents a 62% premium from where Yahoo stock closed on Thursday.

Shares of Yahoo (YHOO, Fortune 500) shot up 50% at the start of trading Friday, while shares of Dow component Microsoft (MSFT, Fortune 500) tumbled about 5%.

Steve Ballmer, Microsoft's chief executive, called the move the "next major milestone" for the software giant.

"We are very, very confident this is the right path for Microsoft and for Yahoo," he said.

Microsoft hopes to close the deal by the end of the year. Ballmer said that Microsoft has been in "off and on" talks with Yahoo for 18 months and said he called Yahoo CEO Jerry Yang Thursday night to tell him the bid was coming.

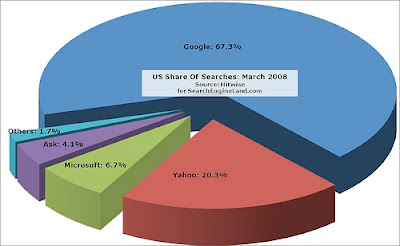

A Microsoft-Yahoo combination would create a powerful number two player in the online search business, which Google commands. The leading search engine reigns over 58.4% of the U.S. search market, while Yahoo has 22.9% and Microsoft's share is just 9.8%, according to comScore, a research firm that tracks Internet traffic.

Microsoft made the bid early Friday. In a statement, the company said the offer allows Yahoo shareholders to elect to receive cash or a fixed number of shares of Microsoft common stock, with the software giant's offer consisting of one-half cash and one-half Microsoft common stock.

In a statement, Yahoo acknowledged receipt of the offer and said its board would evaluate the proposal "carefully and promptly."

Both Microsoft and Yahoo have fallen far behind rival Google (GOOG, Fortune 500) in the lucrative field of Internet search. Yahoo's earnings and share of the online search market have badly trailed Google.

In a letter it sent to Yahoo's board of directors, Microsoft disclosed it had explored a Microsoft-Yahoo deal a year earlier, only to be rebuffed by Yahoo, which said at that time it was confident of the "potential upside" for Yahoo from operational changes it planned.

"A year has gone by, and the competitive situation has not improved," said Ballmer.

On Thursday, former Yahoo CEO and current Chairman Terry Semel, who opposed an earlier approach Microsoft made last year, resigned from the Yahoo board.

Friday, May 25, 2007

Google Hot Trends

Thanks to google hot trends , now , bloggers can write about those topics which are being searched by all. It will also help people from India etc. to keep track of what people are surfing abroad . It is a rival to yahoo's top online search .

Tuesday, May 8, 2007

Microsoft Should Buy Yahoo

In the battle of online search, Microsoft is again courting Yahoo, according to media reports

Microsoft should acquire Yahoo! in order to fend off Google and solidify the software giant's Internet presence, according to a Friday report by Merrill Lynch.

“The possible acquisition of Yahoo would be a strategic positive in our view,” said Justin Post, a Merrill Lynch analyst and author of the report.

Post said that Microsoft’s goal is to make advertising a significant new revenue stream, possibly even larger than the core operating system business, and buying Yahoo! would be a large step in that direction..

“A Yahoo/MSN-Microsoft combination would have garnered approximately 41% share in the US of search queries [in April] versus Google (nasdaq: GOOG - news - people ) with 44%,” Post said.

Google is already venturing into Microsoft’s territory with the recent launch of their spreadsheet and their partnership with Adobe Systems (nasdaq: ADBE - news - people ), Post said.

Yahoo! would be Microsoft's best prospect from a strategic standpoint, according to Post, because Bill Gates and company could thereby eliminate a top competitor and because Microsoft’s search and advertising focus on personal computers, mobile dives and video games fits well with Yahoo!’s business strategy.

The latter company’s large presence in Japan would also bolster Microsoft’s business platform in Asia, the analyst said.

A good second option, however, could be eBay (nasdaq: EBAY - news - people ), he added.

“Worse case, an acquisition of eBay or Yahoo! could cost Microsoft $5 a share if completely unsuccessful,” Post said. “However, Google’s potential encroachment on Microsoft’s core software market, using Internet profitability to fund software investment, represents a long-term business risk.”

In a way, they’re two tech titans that could badly use each other: Microsoft (MSFT) and Yahoo (YHOO), both hobbled by an 800-pound gorilla that has come to dominate search.

According to newspaper reports May 4, Microsoft has asked Yahoo to enter formal negotiations for an acquisition that could be worth $50 billion. Yahoo's market capitalization was about $38 billion at the close of trading May 3.

Reports of the deal sent Yahoo shares jumping 17% in premarket trading, while Microsoft slipped 1.5%.

The Wall Street Journal and the New York Post reported Friday that executives of the two companies are in early-stage discussions of a merger or some other kind of collaboration, although Microsoft officials would prefer to acquire the company outright. The companies held similar discussions a year ago, but no deal came to fruition, the newspaper reported, citing people familiar with the talks.

Still, any deal is far from certain, the reports noted.

Among bloggers on the Net, there is plenty of skepticism about a merger because of the size of the deal, the differences in culture, the abundance of executive egos, and the redundancies in technology. "If Microsoft buys Yahoo, Microsoft should immediately spin the Yahoo-MSN business out as a separate company," says Henry Blodget, the one-time analyst at Merrill Lynch (ML), who now writes the Internet Outsider blog. "If it doesn't, both Yahoo and MSN will die." (see BusinessWeek.com, 5/4/07, "Yahoo, MSN "Will Die"").

Microsoft is feeling increasing pressure to compete with Google (GOOG), which plans to beef up its portfolio with a $3.1 billion purchase of online advertising company DoubleClick.

Microsoft currently trails both Yahoo and Google in the lucrative and growing business of Web search. For its part, Yahoo has stumbled in recent years with a lack of strategic focus and laggardly technology at a time when Google has been able to monetize its search prowess to a degree that has startled investors.

Google won a search advertising deal with AOL (TWX) in 2005 that the Post said Microsoft wanted. In addition, Google has developed an array of Web-based software that, while not as robust as the tools in Microsoft’s suite of Office products, presents a severe future threat.

The Post story said Microsoft and Yahoo have held informal talks over the years and said Microsoft's latest approach to Yahoo signals increased urgency.

Earlier this week, Yahoo said it would buy 80 percent of advertising exchange Right Media for $680 million, increasing its stake in that company to full control.

Yahoo shares surged nearly $5, or 17%, to $32.96 at midday trading, near its 52-week high of $34. Shares of Microsoft fell 1.5% to $30.51